what is fsa health care 2022

Health Insurance Actuary and Affordable Care Act Expert Published Jun 30 2022 Follow The state of the United States. Get a free demo.

How I M Using The Qsehra Managed By Take Command Health To Deduct My Employees Healthcare Benefit Best Health Insurance Medical Health Insurance Free Health Insurance

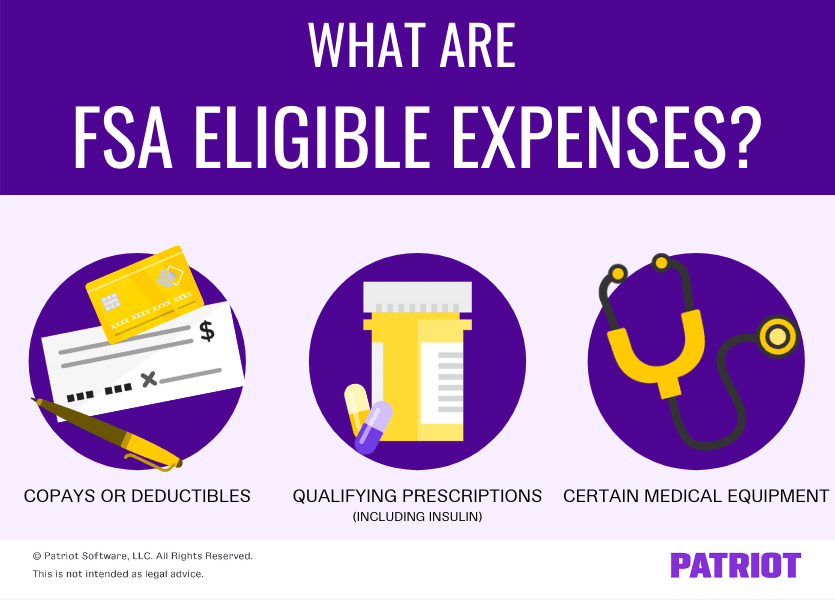

A Health Flexible Spending Account also known as an FSA is a type of pre-tax benefit where you receive significant savings on medical dental and vision expenses for you.

. There are a few things to remember when it. Basic Healthcare FSA Rules. A healthcare flexible spending account FSA is an.

The usual carry-over limit is 550. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year. These expenses arent covered by your employers health insurance plan but they are eligible.

Second your employers contributions wont count toward your annual FSA contribution limits. Ad Custom benefits solutions for your business needs. Ad Free Shipping No Hidden Fees.

Everything from medical expenses that arent covered by a health. Employers set the maximum amount that you can contribute. The amount of money employees could carry over to the next calendar year was limited to 550.

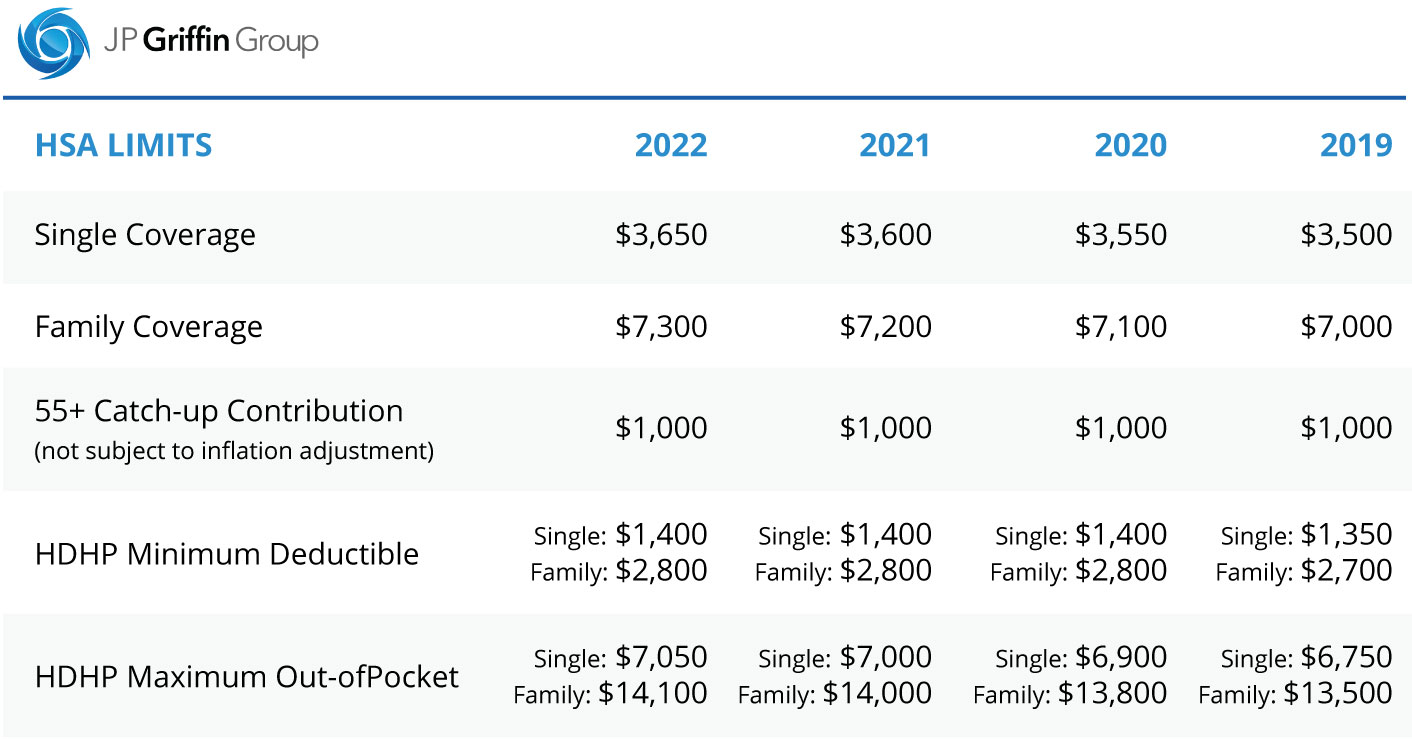

Flexible Spending Accounts program - new 2022 limits for the HCFSA and LEX HCFSA. Elevate your health benefits. An FSA is a kind of employer-sponsored spending account that enables workers to put aside pretax earnings to pay for qualifying health care and dependent care expenditures.

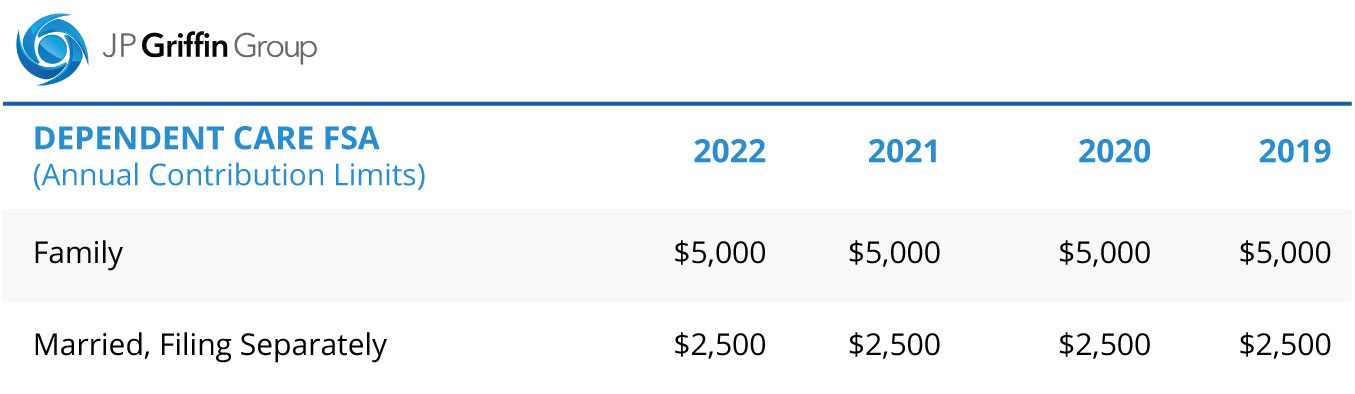

As a result the IRS has revised contribution limits for 2022. Common purchases include everyday health care products like bandages thermometers and glasses. Like health care FSAs dependent care.

A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. Free Torn Lens Replacement. Health care FSAs and dependent care FSAs DCFSAs have annual contribution limits that you cant exceed during the year.

The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account. The IRS announced that for plan year January 1 through December 31 2022 federal employees can contribute 100 more into their health care flexible spending account. An FSA is a type of savings account that provides tax advantages.

However the Act allows unlimited funds to be carried over from plan year 2021. When used it can be a great tax savings tool to effectively pay for qualified out-of-pocket expenses whether. 2022 information About Navia Benefit Solutions Navia Benefit Solutions administers the Medical Flexible Spending Arrangement FSA Limited Purpose FSA and Dependent Care Assistance.

Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. The 2022 limits are good to know for planning purposes ECFCs Sweetnam said Employers generally start talking to their employees about making health care choices and. Heres how a health and medical expense FSA works.

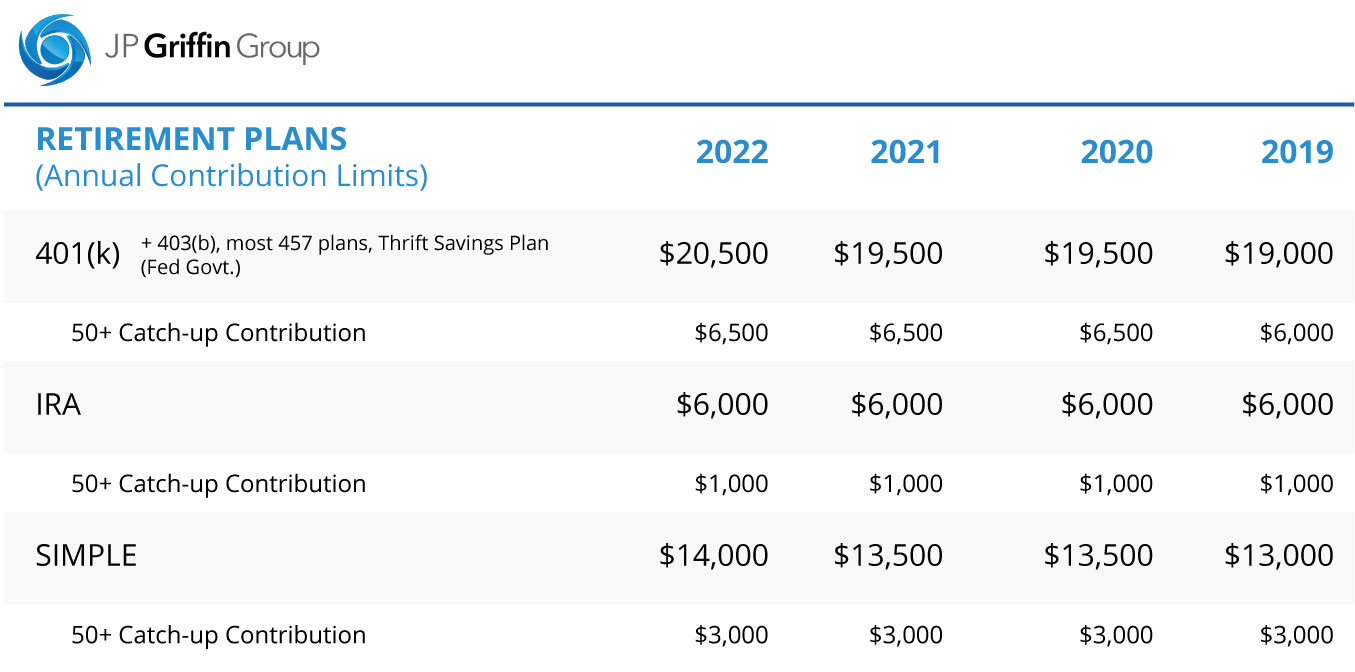

An FSA is a tax-advantaged way for you to pay for certain medical expenses. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. The Supreme Court of the United States has now published its decision in Dobbs vJackson and as anticipated the decision overturns prior Supreme Court.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. A Health Flexible Spending Account FSA is an employer-sponsored reimbursement arrangement that allows employees to set aside pre-tax money on an annual basis to pay for. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

So if you had 1000 in your account at the end of this year you could carry it all over into 2022. You can contribute up to 2850 in 2022 but you can adjust your amount only during open enrollment or if you have a qualifying event such as getting married or having a. Dave Dillon FSA MAAA Expand search.

An FSA is a tool that may help employees manage their health care budget. Easy implementation and comprehensive employee education available 247. The IRS hasnt yet announced 2022 limits but your employer can.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Best Deals And Coupons For Lenscrafters Lenscrafters Sale Design Sunglasses Branding

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

What Is An Fsa Definition Eligible Expenses More

Hra Vs Fsa See The Benefits Of Each Wex Inc

What Is Hipaa Compliance Read Our Hipaa Compliance Checklist Guide For 2021 Everything Hipaa Compliance Health Information Management Healthcare Compliance

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Otc Card Eligible Items At Walmart Dear Adam Smith In 2022 Health Savings Account Prepaid Credit Card Walmart

What Is A Health Care Spending Account In Canada

Medicine Stock Photo Containing Medical And Health In 2022 Health Stock Photos Photo

The Different Components Of Health Administration Healthcare Administration Healthcare Business Health Administration

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Lenscrafters Deals 60 Off Frame Lenses With Free Shipping Lenscrafters Coupons And Deals For March 2022 Lenscrafters Sunglasses Branding Lenses

Kirkland Signature Nondrowsy Allerclear Antihistamine 10mg 365 Tabletsdefault Title In 2022 Herbal Supplements Tablet Allergies

Brene Brown In 2022 Podcasts Bilingual Songs Brene Brown

Irs Releases Fsa Contribution Limits For 2022 Primepay

Always Discreet Size 6 Extra Heavy Absorbency Long Women S Incontinence Pads 90 Count In 2022 Incontinence Pads Incontinence Incontinence Products Woman

A Quick Guide To Flexible Spending Accounts Accounting Health Savings Account Flexibility